Establishing a strong foundation for our community’s future is a vision shared by donors who have endowment funds at The Dayton Foundation. The following funds are some of the new endowments established by donors in recent months to support their special charitable causes and our region, now and in the future.

Edna M. Baker Fund generates unrestricted operating revenue for The Dayton Foundation, the Masonic Home and St. Mark’s Lutheran Church.

Buckingham Advisors Scholarship

Buckingham Advisors Scholarship helps students pursuing a finance, financial services or accounting degree to further their education. This scholarship was established by the Buckingham Big Hearts, a charitable giving committee founded by Buckingham Advisors’ employees, whose mission is to create a heartfelt, meaningful impact in the community through creative collaboration and philanthropic efforts.

Marva Cosby Charitable Fund

Marva Cosby Charitable Fund honors the charitable wishes of the late Marva Cosby, a longtime member of the Foundation’s Governing Board and the first African-American woman to serve as its chair. Marva was an active community volunteer and named one of Ten Top Women in 2012 by the Dayton Daily News.

Clarence A. DeLima Charitable Fund supports the needs of 12 charitable organizations spanning many fields of interest, including medicine, animals, basic human needs, reproductive health rights and world crisis assistance. Dr. Clarence DeLima was a 1964 graduate of the Topiwala National Medical College in Mumbai, India. He later immigrated to the U.S. and practiced psychiatry in Dayton.

The Fuchs Memorial Scholarship Fund provides an eighth-grade tuition scholarship to a student who attended St. Charles School continuously from kindergarten through seventh grade.

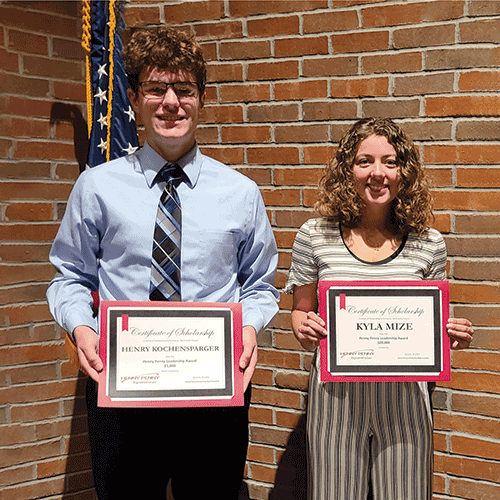

Henny Penny Leadership Award Scholarship Fund

Henny Penny Leadership Award Scholarship Fund supports a graduating Preble County senior, who demonstrates exemplary leadership in pursuing their entrepreneurial future, in attending a two- or four-year school or university. For more than 65 years, Henny Penny Corporation has provided kitchen operators across the globe with efficient and sustainable food service equipment.

John H. Kaufmann

John H. Kaufmann Fund honors the memory and charitable wishes of this 1974 University of Dayton alumnus by awarding scholarships to select students who wish to attend Central Bible College or Evangel University in Missouri.

The Nelson Family Charitable Fund supports organizations that provide and initiate charitable services in the community.

The Schweikhart Family Charitable Fund supports the charitable interests of the Schweikhart family.

Albert S. Staub Fund generates annual income for local nonprofit organizations, such as the Dayton Performing Arts Alliance, The Foodbank, Inc., and St. Mary’s Development Corporation. This fund honors the legacy of Albert Staub, who was a professor at the University of Dayton and a principal player for the Dayton Theatre Guild.

Sandra and Richard Stevens

Richard and Sandra Stevens Designated Fund supports nonprofit organizations addressing basic human needs in the Dayton Region.

Sue Ann and Otto Lee Wiedeke

Otto Lee and Sue Ann Wiedeke Depository Fund honors the memories of the donors by awarding grants to nonprofit organizations important to them. Otto “Lee” Wiedeke and Sue Ann “Sudy” Wiedeke were married for 25 years and found fulfillment in serving as active members of the Church of the Incarnation and their community.

The following funds recently were established by individuals who took advantage of the IRA Charitable Rollover, which allows individuals age 70½ or older to transfer up to $105,000 from their IRA to a qualified public charity tax free.

Barry Adamson Designated IRA Fund

The Alan and Kathleen Biegel IRA Fund

Jerry and Tess Biersack Charitable IRA Fund

Lois and Donald Bigler Charitable IRA Fund

John Blair and Luanne Handley-Blair Designated IRA Funds

Cleanne Cass and Rand Ray IRA Fund

The Kendall D. Cobb Charitable IRA Fund

Diane DuBose Charitable IRA Fund

The Eckstein Family Charitable IRA Funds

Eddington Family Charitable IRA Fund

Geoffrey and Linda Edwards Charitable IRA Fund

Raymond P. Ten Eyck Charitable IRA Fund

Flynn Family Charitable IRA Fund

Ronald Footer Charitable IRA Fund

Angelita Gabatin Designated IRA Fund

Dr. John and Denise German IRA Fund

William and Barbara Goetz Charitable IRA Fund

Gomez Family Charitable IRA Fund

Grandpa’s 2324 Charitable IRA Fund

Virginia and Edman Gray IRA Fund

Robert Gutmann Charitable IRA Fund

Donald and Susan Harker Charitable IRA Fund

Richard and Marilyn Hoback Charitable IRA Fund

Hoffman Charitable Giving IRA Fund

Larry Hollar and Karen Cassedy Designated IRA Fund

Bob and Kathy Hutter Charitable IRA Fund

Janice James and Joyce Gibbs Charitable IRA Fund

Alisa and Timothy Janz Charitable IRA Fund

The Allan M. Jones Charitable IRA Fund

The Robert Jones Charitable IRA Fund

Jude 2 Designated IRA Fund

Norma Keefer Charitable IRA Fund

Emil P. and Jean M. Kmetec IRA Fund

James J. Longley Giving IRA Fund

Arthur and Bebby Marlin Charitable IRA Fund

Judy McCormick Charitable IRA Fund

Earl and Linda Moyer Charitable IRA Fund

Elaine Musick Charitable IRA Fund

Wally Nugent Charitable IRA Fund

Orosz Family Charitable IRA Fund

Kay Lawrence Price Designated IRA Fund

Richard A. and Judith A. Russell Charitable IRA Fund

Teri Sand Charitable IRA Fund

Richard and Jacqueline Siefring Charitable IRA Fund

Skelley, Lindquist-Skelley IRA Fund

B. Smith IRA Fund

Don and Elaine Steiner Charitable IRA Fund

John and Carla Stengel IRA Fund

Mitzi and John Stuckey Charitable IRA Fund

George and Rene Sutton Charitable IRA Fund

Janis Vargo Charitable IRA Fund

Mr. and Mrs. W.G. IRA Fund

Wagner IRA Fund

Wahl Family Charitable IRA Fund

Walbroehl Charitable IRA Fund

Betsy B. Whitney Charitable IRA Fund

Thomas O. Williams Charitable IRA Funds

Jo Helen Wiliams Designated IRA Fund

John and Susan Witherspoon Charitable IRA Fund

Dennis and Anne Wolters IRA Funds

Please note that IRA transfers may not be made to a supporting organization, private foundation, Donor-Advised Fund or Charitable Checking Account.℠ To find out if this charitable-giving option may work for you, contact a member of our Development and Donor Services staff at (937) 222-0410.