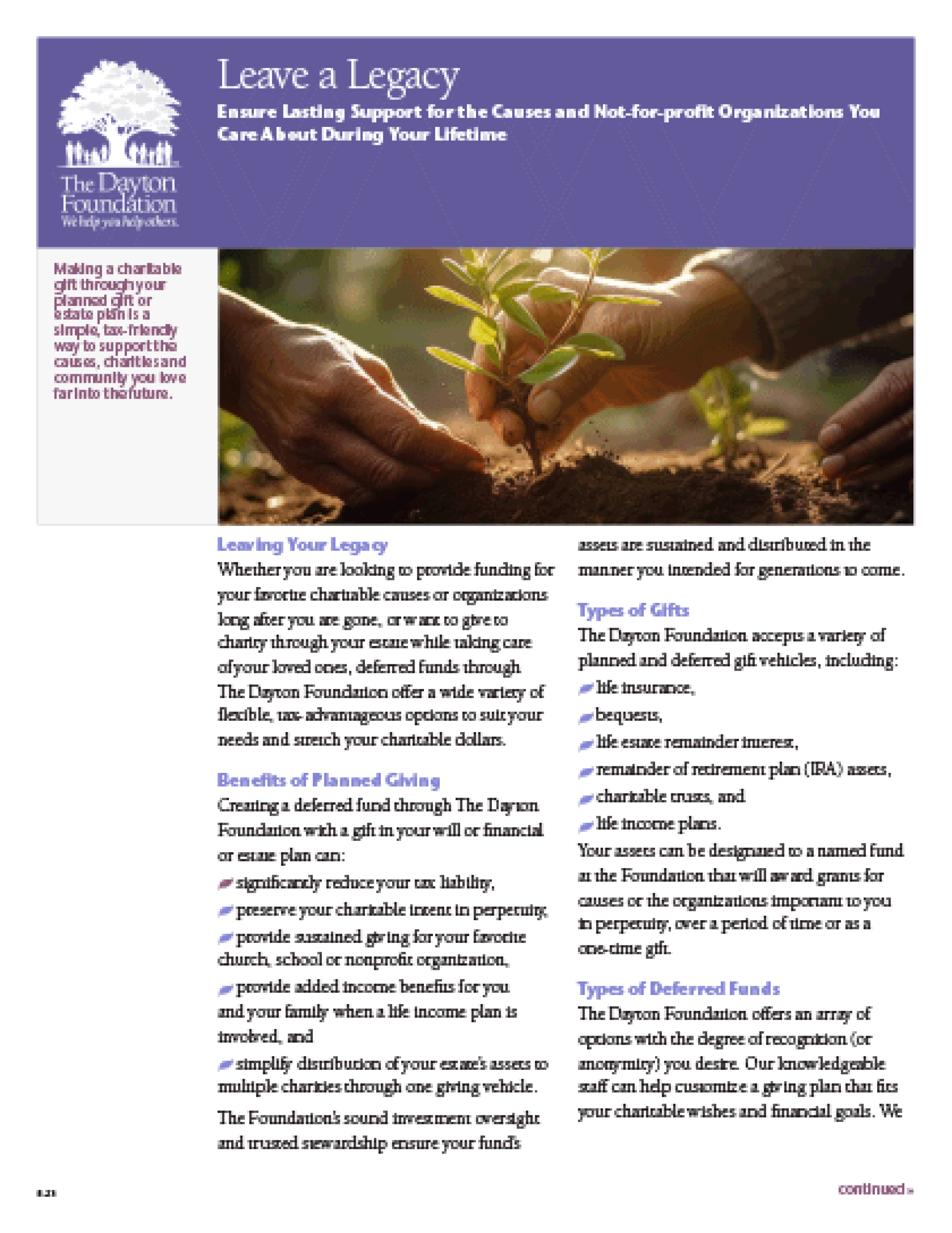

Leave a Legacy

Ensure Lasting Support for the Causes and Not-for-profit Organizations You Care About During Your Lifetime

How to Make the Most of Your Charitable Gifts

An introduction to The Dayton Foundation and its services and benefits for donors

Your Charitable Giving Options with The Dayton Foundation

A handy chart of available fund options and deferred giving gift vehicles

If You Make Gifts to Charity, This is for You: Charitable Checking Account Service

An introduction to The Dayton Foundation’s tax-wise, convenient service for doing regular charitable giving

Guidelines for Using Your Charitable Checking Account

Detailed information about how a Charitable Checking Account works, including types of assets that can be used to fund accounts, directing grants, claiming tax deductions and more

Better Than a Private Foundation: Family Foundation Plus

Information about a more cost-effective, tax-advantageous private foundation alternative that offers the benefits of a private foundation... and more

How to Be a Hero to Your Clients

An introduction to the advisor partnership with The Dayton Foundation to deliver the most tax-wise and effective charitable giving methods to clients

Community Impact Endowment Funds

An introduction to a fund option that enables individuals and families to help The Dayton Foundation meet pressing community needs, no matter how times may change

Donor-Advised Funds

Information about this flexible fund option that allows you to remain actively involved in awarding grants

Ways to Give Through and to Your Charitable Fund

Brief explanations of planned, current and deferred giving options, including charitable gift options that can provide income for you and others for life

Charitable Gift Annuities

Information about this simple, easy-to-use charitable gift option that enables you to generate supplementary income and create a lasting charitable gift

The IRA Qualified Distribution

Information about how The Dayton Foundation can help you make the most of your annual IRA required minimum distribution

Field-of-Interest Discretionary Funds

Information about making your gift flexible to support evolving needs and nonprofits focused on your area of interest

Scholarship Funds

Information about giving the gift of education

Donor-Designated Funds

Information about this hassle-free method for providing perpetual support to your favorite charities

Selling Your Business?

Information about how selling your business can benefit you and your favorite charitable organizations